New Delhi: The Income Tax Department has once again tried to reduce the usage of cash transaction. In its latest press release it further warned people against cash transactions of two lakh rupees or more.

The Department said that in such transactions, the person who receives the cash will be fined. The penalty will be equal to the amount taken. The department also said to the common people that if they have any information about such transactions then they can give the details.

Significantly, the government has banned cash transactions of two lakh rupees or more from April 1, 2017 under the Finance Act-2017. The newly added section '269 ST' in income tax law does not allow it. The tax department has said in the advertisement published in major newspapers that penalty for violation of section 269 ST will have to be imposed.

In the budget of 2017-18, Finance Minister Arun Jaitley had proposed to ban cash transactions of more than three lakh rupees. Later this amendment was reduced to two lakh rupees by amending the Finance Bill. The Finance Bill was passed in the Lok Sabha in March. The Income Tax Department has said that this limit will not be applicable to any receipt of the government, banking company, post office savings bank or co-operative bank.

The ban on cash transactions over a certain limit is aimed at curbing black money. The Income Tax Department had started an email address in last December after the ban was imposed, on this email address any cash transactions of more than two lakh rupees can be informed

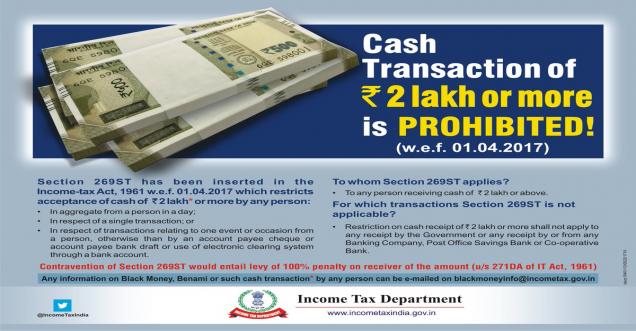

Cash transaction of Rs.2 lakh or more is prohibited !

— Income Tax India (@IncomeTaxIndia) June 2, 2017

(w.e.f. 01.04.2017) pic.twitter.com/F2UYjNkvj5

As mentioned in the tweet from the Income Tax India

Section 269ST has been inserted in the Income-tax Act, 1961 w.e.f 01.04.2017which restricts acceptance of cash of Rs 2 lakh or more by a person:

- In aggregate from a person in a day;

- In respect of a single transaction; or

- In respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account.

To whom it may concern

To any person receiving cash of Rs 2 lakh and above.

For which transactions Section 269ST is not applicable?

Restriction on cash receipt of Rs 2 Lakh or more shall not apply to any receipt by the Government or any receipt by or from any Banking Company, Post Office Savings Bank or Co-operative Bank