New Delhi: The Goods and Service tax (GST) being implemented on July 1, 2017 has brought a regime in the Indian tax regime which will be remembered for 100 of years from now. This is really a revolutionary idea being thought and implemented and truly India hence forth is going to be called as One Nation one Price.

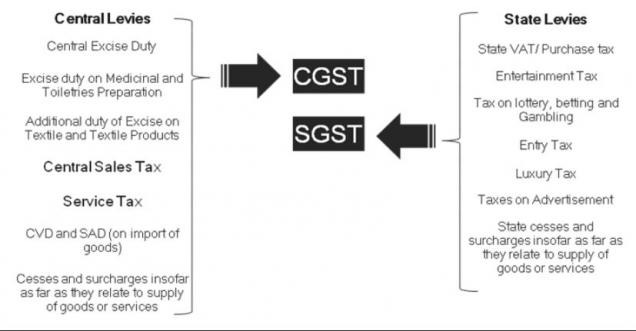

The objective of the GST was to remove the various taxes being involved from central to the state government. its objective is to make every one understand India is one nation and where ever you do the business and where ever your product goes in India we have to pay the same tax.

Central taxes that The GST will replace

#1. Central Excise Duty

#2. Duties of Excise (medicinal and toilet preparations)

#3. Additional Duties of Excise (goodsof special importance)

#4. Additional Duties of Excise (textiles and textile products)

#5. Additional Duties of Customs (commonly known as CVD)

#6. Special Additional Duty of Customs (SAD)

#7. Service Tax

#8. Cesses and surcharges in so far as they relate to supply of goods or services

State taxes That The GST will Subsume

#9. State VAT

#10. Central Sales Tax

#11. Purchase Tax

#12. Luxury Tax

#13. Entry Tax (all forms)

#14. Entertainment Tax (not levied by local bodies)

#15. Taxes on advertisements

#16. Taxes on lotteries, betting and gambling

# 17.State cesses and surcharges

What’s Out of GST…

Alcoholic liquor for human consumption

Petroleum crude, high speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel — GST Council will decide until when

… AND What’s In

Tobacco, tobacco products. Centre may impose excise duty on tobacco

Read other latest news on GST: